We invest in people on a mission to build sustainable systems and healthy communities

Making more with less

Reduce and reuse waste

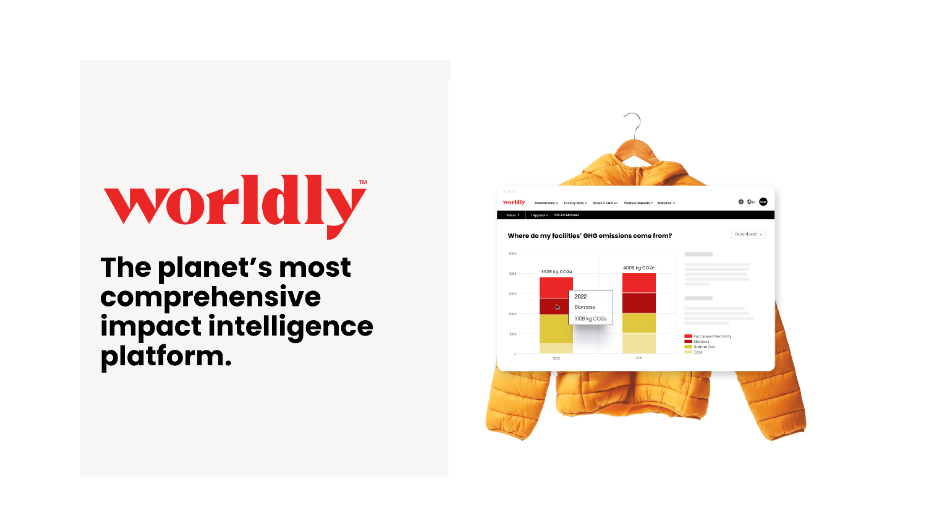

Regenerative circular supply chains for apparel and other consumer products

Education for employability

Compensate people for personal data

Jobs and economic empowerment

Housing solutions